I went to Ada’s Books last week. They had a lot of textbooks, which I wasn’t too interested in. They also had a lot of science books, which I wasted half my day (alright, just 20 minutes) perusing. I ended up buying Group Theory in the Bedroom. It’s a collection of essays some guy wrote for a variety of science magazines.

A couple days ago I read an article in the book about conserved economies. The idea is that you can model economic behavior if you make some simplifying assumptions (like that people spend exactly as much as they earn). What really intrigued me about the article were the graphs of wealth distribution over time. By slightly tweaking various economic parameters, it’s possible to make economies collapse by concentrating all wealth in the hands of one person.

I’ve been toying with Processing a lot lately, and these graphs finally gave me an excuse to get started. I wrote up a quick toy economy sketch and generated my own versions of the economies described in the book.

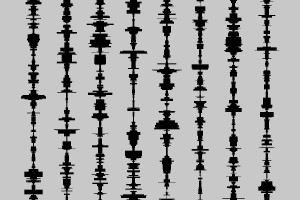

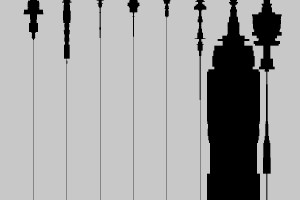

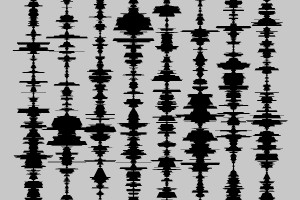

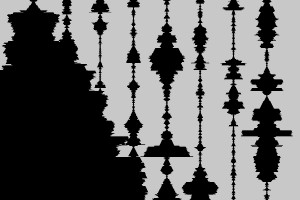

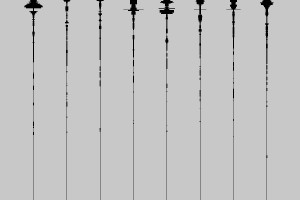

These economies are super simple. No one ever makes or loses money, except in a transaction with someone else. In those transactions, someone makes money and someone else loses money. Each line is a person’s wealth over time (time 0 is at the top). The width of the line corresponds to how much money they actually have.

So we’re basically assuming that everyone has some amount of money in savings, and that they spend exactly as much as they make. I like saving, so I added a savings feature. Everyone gets one unit of wealth each time step. In order to keep people from accumulating infinite wealth, I set up a random event that would force them to spend their savings. Now each person saves for a rainy day, and they periodically experience those rainy days and have to spend their savings.

A normally stable economy remains essentially stable. People do manage to save up a higher maximum amount of money, but they don’t really keep it for very long. It also doesn’t give people a leg up in exchanges.

That changes in an unstable economy. The person who ends up owning all the wealth really gets it all. It’s kind of ridiculous. Surprisingly, even the people who don’t get very wealthy still don’t get as poor as they would have if they hadn’t saved a little. It seems that extra boost gives them a little more leverage in an exchange. One thing to keep in mind about this is that the agents aren’t allowed to go into debt. If agents could have negative money, this situation might be very different.

Since I’ve been interested in startups and entrepreneurs for a while, I decided to add that into my economy as well. I gave entrepreneurs some chance to win much more than they already have, but also to lose much of what they had. It turns out this is a hard thing to get stable. If succeeding in a startup is too hard (and too many people try), the entire economy collapses pretty quickly. On the other hand, if it’s very easy then everyone ends up ridiculously wealthy. It seems like that kind of situation would lead to hyperinflation, which wouldn’t really be a good thing.

These models are way too simple to accurately represent a real economy. Real economies have a lot of intricacies that I didn’t want to go into for this. One of my EE professors once said that we’d never find the “Maxwell’s Equations of Economics” because there was simply too much going on. That’s probably true, but there’s something poetic about modeling economies in such a simple way.